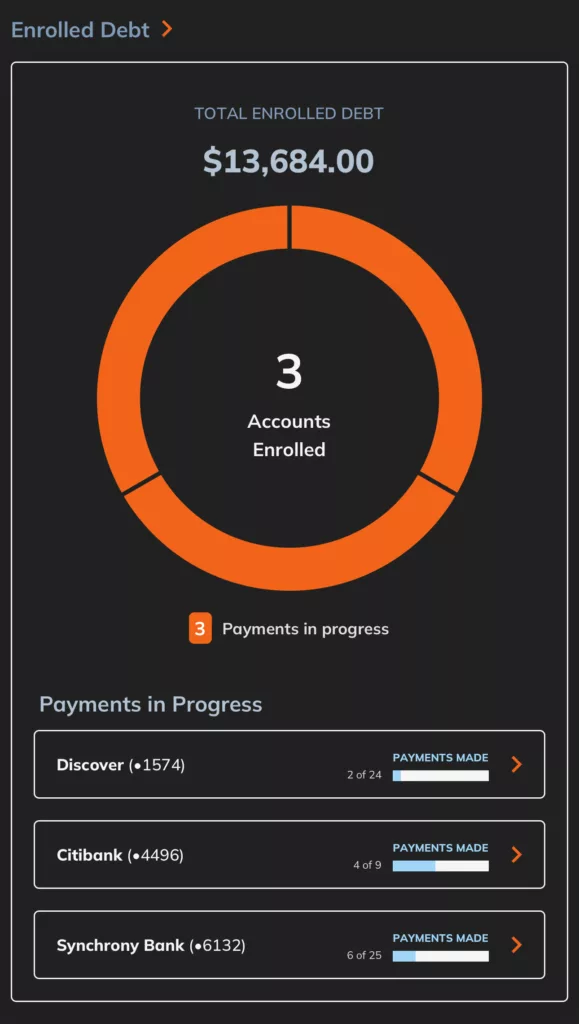

A couple months ago, I wrote about how I was dealing with massive debt. It’s been about a year now since I officially started dealing with debt. I’m happy to report that all of the accounts have been settled.

The last settlement was made a couple months ago and I’ve since made two payments to that creditor. I’m paying like $700 a month towards debt, which sucks, but it’ll only be until the end of next year. At least my credit is already going up and I have being debt free to look forward to next year.

Issues Along The Way

I wish I could say it was an easy and smooth process. In my last post, I had mentioned that one creditor had been calling my family members and I had to explain my situation to my family, both immediate and extended family. I ended up calling that debt collector back and it actually was an easy and reasonable process to settle that account outside of my debt program. Made me wish I had just answered and heard them out the first time.

A Lawsuit

The other bump in the road was getting served by Discover. The worst part is they sent the summons to my parents’ old house that they moved from. The house hadn’t sold yet and the summons letter was just shoved in the front door. If my mom hadn’t gone to check on the house, I would have had no idea. When we found it, my lawyers had already negotiated a settlement with Discover. Naturally, I was furious. I spent a lot of time on the phone with the debt people and thought it was figured out.

Present day, as in like in the last few weeks, I got a letter from the court saying there was a decision made in the case. Once again, I was livid because I have already made two payments to Discover. It was settled outside of court and now the court is just wasting their time making decisions on something that has already been settled and requires no legal action. I have proof of payment AND a copy of the offer letter that was signed off on. The case should have been dismissed after that, but nope. That’s actually something I still need to deal with. I’ll have to call Discover’s lawyer and the courthouse.

Lessons

Since this whole ordeal, I don’t get embarrassed about being poor anymore. I’m just blatantly honest with people about where I stand financially. Like, I’ll literally screenshot my bank account and be like “listen, I don’t have the money to do that right now” and thankfully, everyone is understanding about it.

I’m able to have honest conversations about money and finances with my boyfriend, which was something I felt that I couldn’t do with my ex. If I can’t afford groceries, I let my boyfriend know. If he doesn’t have the time to go to the store, he’ll give me his card to take care of it. But mostly, we’ll go together and he’ll pay when I can’t afford to help with groceries.

I’m able to voice that I feel bad about not being able to help more financially and how paying off debt is running me a bit dry because I have to pay so much a month. Not once does my boyfriend make me feel bad about it. He literally said “You have a roof over your head and food in the fridge, do what you gotta do to take care of the debt.” I’m really lucky to have a boyfriend who is so understanding and safe. It’s nice not having financial stuff held over my head.

Looking For A New Job

I’ve accepted that my current job does not pay enough. It’s full time with benefits, but in this economy, what I currently make is not a livable wage. Add paying off debt to monthly bills and it’s even less sustainable. Up until I got my tax refund, I was going into the negatives every month. Thankfully, it wasn’t a huge deal because my bank account is with Chime. They spot me when I go negative.

I’ve decided to put myself out there again to try and find a new job. I looked into peer support work and the mental health field. But, I haven’t found anything in those fields worth quitting my job for. However, I have found some jobs that I resonated with and applied for in other fields, but they have really long application timelines so I won’t hear back for a while.

As much as I’d like to make more money, I’m trying to apply for things that won’t make me completely miserable. Working an awful job just for the paycheck is not worth having my mental health deteriorate.

Working On Finances

On top of looking for applying for new jobs, I’m also working on being more mindful of what I’m spending. I haven’t made a budget or anything, but I don’t just constantly get myself little treats like I used to (cough cough, Starbucks). They were just bandaids for my poor mental health lol. I’ve started to do other forms of self-care that are cost effective.

I’m also actually putting money away into a savings now that I can afford to do that (thanks tax refund). On top of that, I do little things for extra cash to put away in my savings like returning bottles, surveys, scanning receipts, etc. Those used to be necessary for me to get by, but now I’m able to put them in my savings. Every little bit adds up.

It’s been an emotionally draining process, but by the end of next year I’ll be debt free! It’s all been worth it. I wish I started dealing with my debt sooner, but better late than never.

-Kailey